Application Fraud Prevention with JuicyScore

Stop fraudulent applications, detect synthetic identities, and assess onboarding risk in real time — without collecting personal data. JuicyScore combines device intelligence and behavioral analytics to help financial institutions catch high-risk users before they enter your system.

Book a Demo

Leaders Grow with JuicyScore

Detect Hidden Fraud at the Entry Point

Application fraud often involves manipulated identities, recycled devices, or scripted behavior — none of which are easily caught by conventional checks. JuicyScore analyzes the digital footprint of each applicant using device fingerprinting, network signals, and behavioral risk markers. Spot inconsistencies, detect multi-accounting, and block fraud rings before they compromise your portfolio.

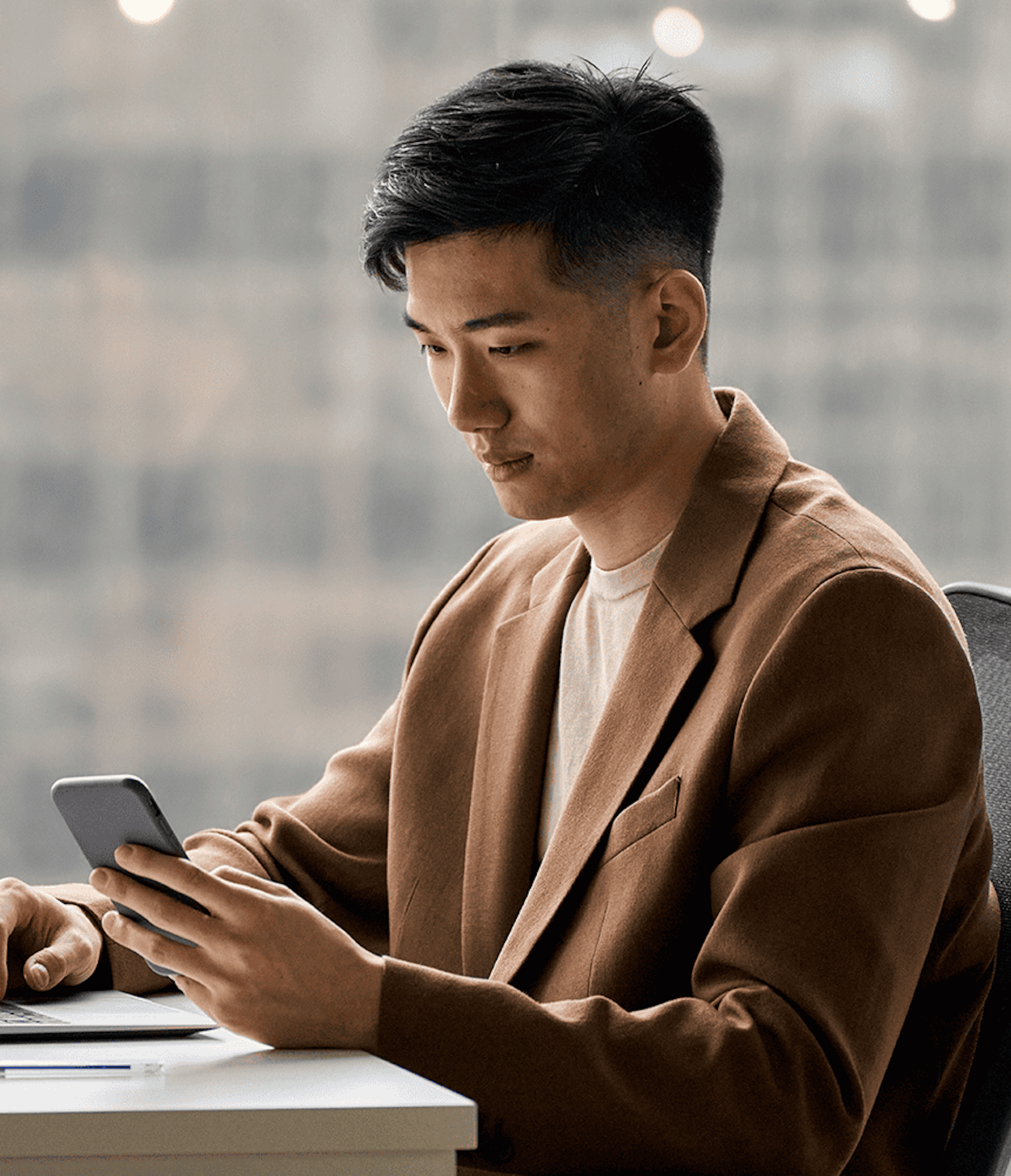

Frictionless Screening for Safer Onboarding

Identify synthetic identities with no reliance on personal data

Block repeat offenders using device-level patterns

Detect automated application scripts, VPNs, and anomalies in user behavior

Assess risk in real time and make faster onboarding decisions

Reduce manual reviews and false positives with smarter scoring

Learn How It Works

Utilizing over 65,000 data points, JuicyScore generates highly predictive risk score models to detect fraud and assess risk in real time. Our output data vector includes device intelligence, user behavioral patterns, internet connection insights, and software data for precise decision-making. Protect your business with advanced fraud prevention while ensuring a seamless customer experience.

Learn more

Our Clients’ Success Stories

Discover Other Products

See How We Spot Fraud Before It Happens — Book Your Expert Session

See It in Action with a Real Expert

Get a live session with our specialist who will show how your business can detect fraud attempts in real time.

Explore Real Device Insights in Action

Learn how unique device fingerprints help you link returning users and separate real customers from fraudsters.

Understand Common Fraud Scenarios

Get insights into the main fraud tactics targeting your market — and see how to block them.

Our Contacts:

Phone:+971 50 371 9151

Email:[email protected]

Leading Brands Trust JuicyScore:

Get in touch with us

Our dedicated experts will reach out to you promptly